By Allan Lengel

ticklethewire.com

By Allan Lengel

ticklethewire.com

Let’s face it, we seldom expect an IRS employee to cheat on their taxes. And then get caught?

Well….meet Albert Bront.

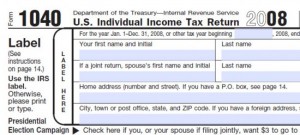

Bront, an IRS revenue agent, pleaded guilty Wednesday in Los Angeles federal court to filing false tax returns for himself and innocent relatives, who were duped, authorities said. He claimed, among other things, bogus deductions for alimony and mortgage payments.

Bront, 51, a former Santa Clarita, Calif. resident, pleaded guilty to one count of subscribing to a false return and two counts of assisting others in subscribing to false tax returns. He admitted filing fraudulent tax returns for the tax years 2003 through 2007.

Additionally, he secretly filed tax returns for his relatives and stole their large tax refunds, authorities said.

Authorities said he had been on unpaid leave from the IRS since 2009, will remain in jail until his April 13 sentencing.

As part of his scam, he prepared a tax return for an unsuspecting relative in 2004, and fraudulently claimed the relative paid property taxes and mortgage interest on a property. He ended up collecting more than $10,000 from the inflated tax refund and failed to report it as income, authorities said.