Allan Lengel

Allan Lengelticklethewire.com

For National Lampoon , the purveyor of humor, which owns interest in such classic films as Animal House, Monday was no laughing matter.

The company’s chief Executive Daniel Laikin, 46, was among seven people charged in a stock fraud scheme that involved National Lampoon and two other companies that artificially inflated stock prices, according to the U.S. Attorney’s office in Philadelphia.

The investigation, which included the Security Exchange Commission, involved a government undercover “cooperating witness” who was paid a kickback by the defendants to make purchases in the “targeted stock with the objective of artificially inflating it’s value,” the U.S. Attorney’s office said. According to the charges against National Lampoon’s Laikin, between March and June 2008, Laikin conspired with a company consultant to pay people, including the government informant, to artificially inflate the price of National Lampoon stock.

One of the people they paid enlisted a Rochester, N.Y. stock promoter who was given about $40,000 to make purchases of National Lampoon stock with the intent to drive up share price, the U.S. Attorneys office said.

Laikin indicated that he wanted the stock to rise from $2 per share to $5 to make it more attractive for strategic partnerships and acquisitions, authorities said. Three of the defendants in Monday’s case were directly tied to National Lampoon. Others were linked to Advatech Corp of West Palm Beach or Swedish Vegas Inc., of Arcadia, California, authorities said.

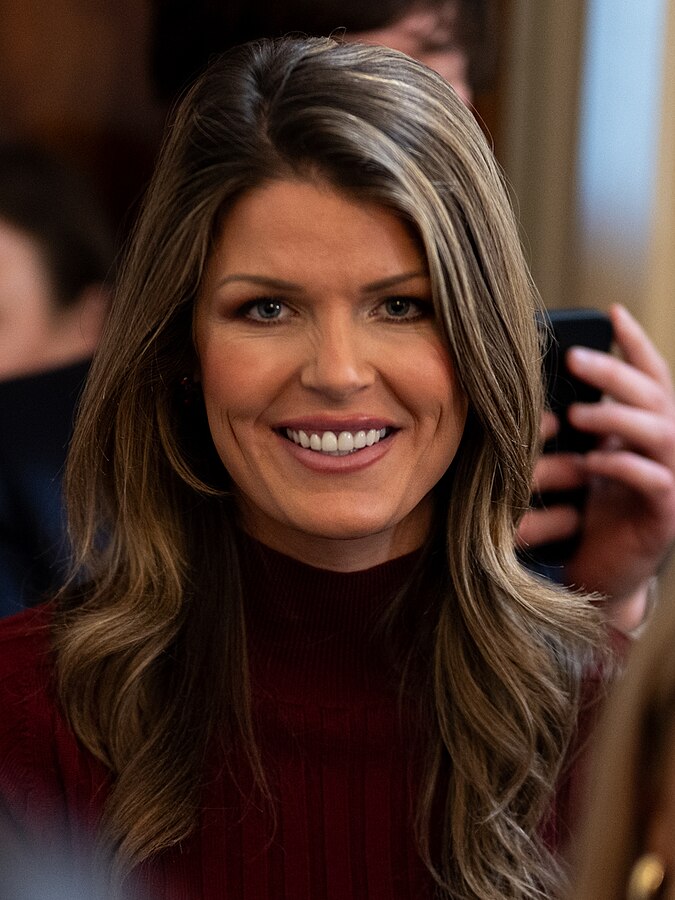

Janice K. Fedarcyk, special agent in charge of the FBI in Philadelphia said in a prepared statement that the defendants “defrauded all of the legitimate market investors who bought and sold shares in these companies. The entire investment market suffers when individuals violate legal and fiduciary trust of their positions.” Marcy Goot, a spokewoman for National Lampoon in Los Angeles, could not be reached immediately for comment.

National Lampoon and Big Screen Entertainment Group (OTC: BSEG) recently announced their partnership. BSEG partner, stock promoter Michael Paloma aka Michael Saquella is currently serving 10 years in prison for stock fraud. Hmm, seems like it’s all related. Is BSEG the next to go down?